The social-justice crowd claims that rent control is the only way to protect defenseless tenants against their oversized landlords. (The previous four posts in this series have shown that the only actor with oversized power in the county’s housing market, and the only actor to blame for the shortage of affordable housing is the county government, mostly by enacting zoning regulations that serve other interests at the expense of the tenants.) Part 1 here – Part 2 here – Part 3 here – Part 4 here

The Elrich-Jawando-Mink triumverate (none of whom scored a majority win in the Democratic primaries and hence have no mandate to do anything) proposes a rent control measure of 3% per year regardless of inflation. Should that measure pass, who will be the winners and the losers? Fortunately we can learn from the experience of other jurisdictions that have enacted similar legislation.

The winners: A few lucky existing tenants

If you are a tenant in a rent controlled apartment, you are golden. You won’t move, even if your Aunt Millie left you a $2 million inheritance, even if you get that big executive promotion, even if you start drawing your teacher’s pension along with Social Security, or even if you’re an empty-nester in a four-bedroom apartment. You have no incentive to move, because if you do move you will pay double or triple your current rent for the same amenities. There are single mothers, immigrant parents, wounded veterans, and recovering addicts who need the housing more than you do, but you won’t relent. In addition, you’ll be able to cheat your landlord by engaging in black-market sublets at the market prices.

Rent Control Is Bad for Tenants and Ruining Landlords

Landlord wins eviction battle against cheating tenant

The winners: Existing home owners

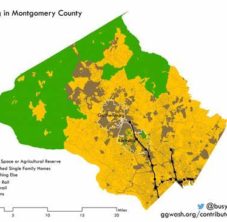

The only reason rent control is the preferred option to promote affordable housing is because the best policy—rezoning land from single-family to multi-family—is far more unpopular. Tenants and homeowners outnumber landlords by orders of magnitude, so landlords are an easy target. All the folks who live in single-family dwellings on 60,000 sq. ft. lots (myself included) dodge the bullet. The landlords are paying for our zoning privileges.

As Rents Soar, States Take Aim at Local Zoning Rules

Residents sue Arlington County over ‘missing middle’ zoning change

The winners: Wealthy renters

There are no income qualifications for rent-controlled apartments. The renters at the Ritz-Carlton Residences in Chevy Chase are paying up to $12,000/month for 2BD/2BA upscale digs. Those rents won’t be going up more than the 3% cap.

The winners: Frederick County landlords

As affordable housing quickly dries up in Montgomery County under rent control, tenants who need affordable housing will be forced to forage elsewhere. Landlords in Frederick and Washington Counties will be more than happy to service that population.

Data shows Montgomery County is shrinking…but Frederick County is growing

The losers: New renters

If you’re a new renter in MoCo, good luck finding an apartment under rent control. The overwhelming historical evidence informs us that developers will not build new rental construction in rent-controlled markets, and existing landlords will do anything to exist the rental market. The results in Takoma Park have been quoted in several local blogs: many rental units will go condo, and the new rental construction won’t materialize.

Documenting the Long-Run Decline in Low-Cost Rental Units in the US by State

The losers: Frederick County renters

Just as low-income MoCo renters will be forced to move to adjacent Frederick County, the current renters there will be forced to contend with increased competition for the rental stock. This phenomenon happens all the time, and the renters in Portland know what it feels like to have new residents pile in from rent-controlled markets such as Los Angeles and San Francisco.

Despite the Blight, Portland Apartment Rents Are Up and May Be Heading Higher