Montgomery County Councilmember Will Jawando really likes raising taxes and hiking fees. He proposed a recordation tax rate hike this past year and got one passed (7-4 vote) through the feckless Montgomery County Council. The rate hike wasn’t as much as he proposed but he knew that was part of the game. He also has a pretty established legislative record of punishment, control and favoritism – as we’ve analyzed repeatedly at CleanSlateMoCo.com.

Now, the wealthy owner of an estate on 2.8 acres in Sandy Spring, MD wants to raise taxes and cap earnings on working class Montgomery County employees in the restaurant and beverage services / bartending sector.

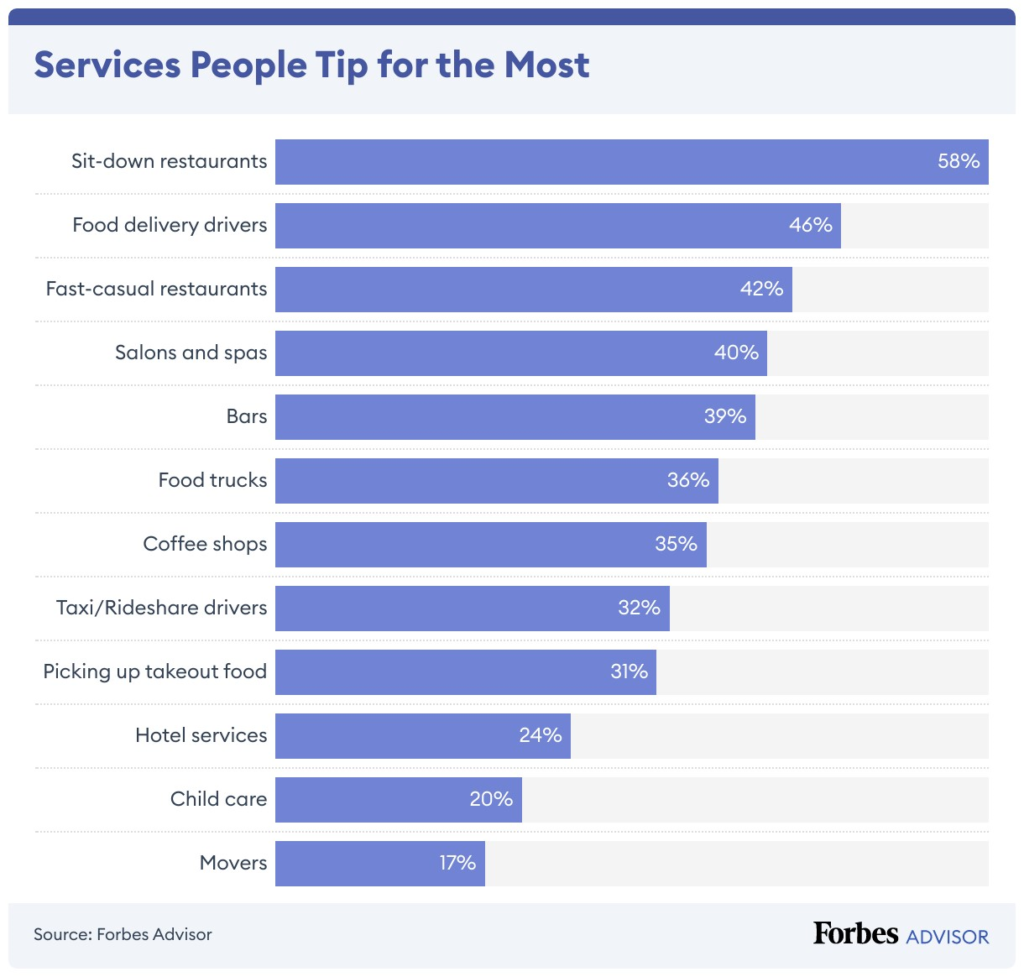

How? Through so-called elimination of the “tip credit” in Montgomery County. The proposal seeks to get rid of a “tip” credit for restaurant / bar owners and force them into paying all staff the full state or County-imposed minimum wage per hour of labor, which is right now between $14.50 and 16.70 in MoCo, dependent on employer headcount.

How is this a direct tax hike on working class people? Simple. We all know many many people still tip at bars and restaurants via cash, not on credit card. Cash tips generally go straight into the pockets of the people who earn them – although sometimes they are pooled with all waiter / bar staff and split at the end of a shift. Cash tips are thus immediately available to the worker(s) at the end of a long night or AM-PM rush. It is an instant payout in legal tender that these folks often use right away – no need to wait for a few days or even a week for the credit card processor and the middle-men to take their little percentage cut and then to deposit the funds onward to the employer’s bank or payroll processor, software which then adds up the tips and withholds taxes and hands it (maybe) off to an accountant for finalizing the payroll processing and disbursement.

And of course, not every cash tip transaction gets taxed because it won’t be reported as income by the receiver of the tip. This isn’t condoning such behavior at all, but it is an economic reality that even the IRS and the state of Maryland revenue office would have to acknowledge — and the compliance costs of tracking down each and every cash tip that goes unreported as income far exceeds the net benefits to “das state” of doing such (tracking each penny) when cash is used.

In an inflationary environment such as we find ourselves in, each day you wait for a paycheck or your tips can essentially be thought of as a tax – the inflation tax. The money you were tipped on Monday is worth less when you receive it on Friday — it simply is. Yes, it is marginal fiat currency deterioration (for now, thankfully) – but it is irrefutably true. This is especially true when gasoline spikes, as it has several times the past two years. Working class people need and deserve their money faster then others to help pay for the cost of living and commuting in Montgomery County. They are getting harmed far worse because of high inflation then Will Jawando is… he is making over $156,000 per year.

So what Will Jawando wants is clear: less tips and less cash in the pockets of working class bartenders and servers and higher taxes on the money they do earn — which is why the vast majority of servers and bartenders do not want his “help” or his wage floor idea.

The Council should follow PG County and table this idea indefinitely.