This week Marc Elrich headed to Annapolis to testify in support of HB470 before the House Ways and Means Committee.

Marc is quick to point out that it is “progressive”, which in Marc’s case means it provides an opening for him to squeeze more money out of the upper and middle class to fund his programs and initiatives.

HB470 is being sponsored by Delegate Palakovich Carr, a Montgomery County state delegate. The bill has to do with tax rates that a county can set. And while the opening is clouded in what sounds like something appealing, “limiting the max tax rate and the number of brackets”, it doesn’t take much to see that it is not something that would empower growth and development in Montgomery County.

Under the proposed bill, a county sets a minimum tax rate of AT LEAST to 2.5% but not more than 3.2% (and 3.7% in 2025) unless of course you:

- Are an individual with taxable income greater than $250,000

- Or filing jointly with a spouse and have an income greater than $300,000

The bill does not specify what the limits of tax a county can impose on these earners.

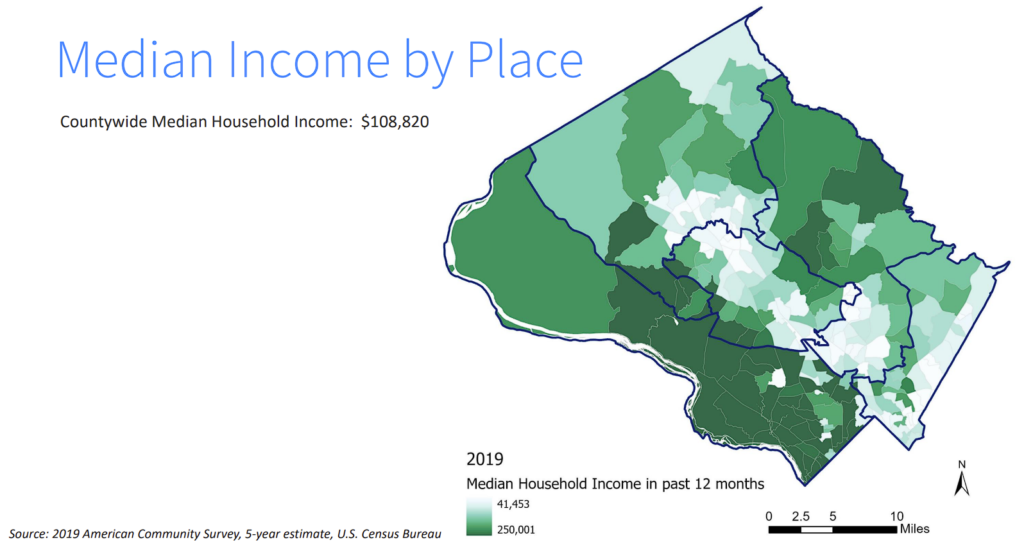

In looking at the income distribution of Montgomery County, published by Montgomery County Planning, you will see that while the median (value exactly in the middle of the dataset) is $117,000 there is a large majority of the county above the $250,000 mark.

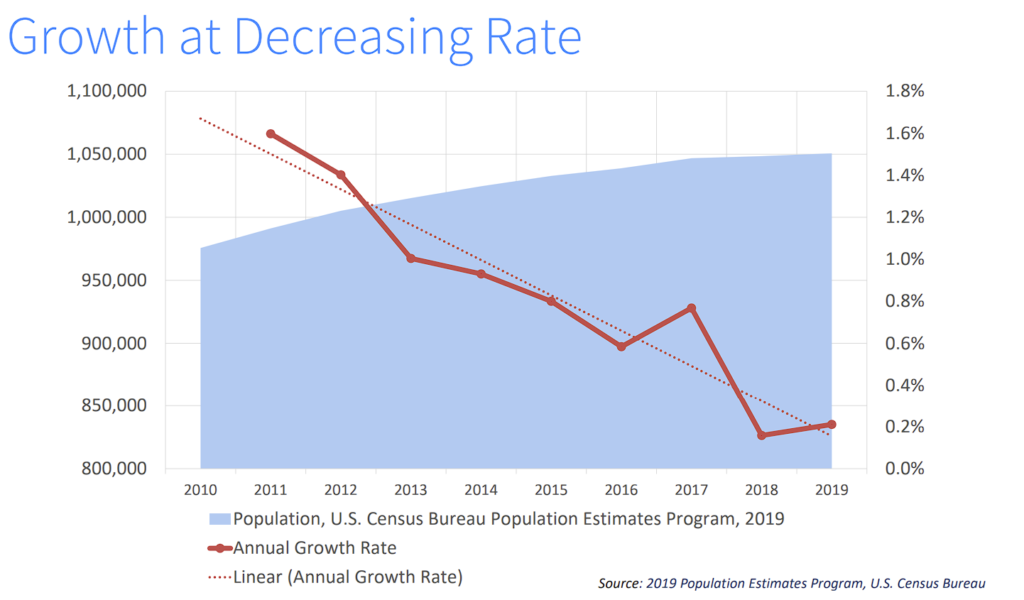

Montgomery County’s current income tax rate is 3.2%, so what this bill does is provide the ability for the tax rate to exceed this amount (in addition to raise it .5% next year). For a county that is already struggling with an ever-decreasing rate of growth, what would motivate these high earners to stick around?

What is more alarming is when you look at the levels set. Is a family making $300,000 in Montgomery County “wealthy”. A couple that both works for the federal government as a GS14 would be considered wealthy. Could this couple even afford to live in Montgomery County?

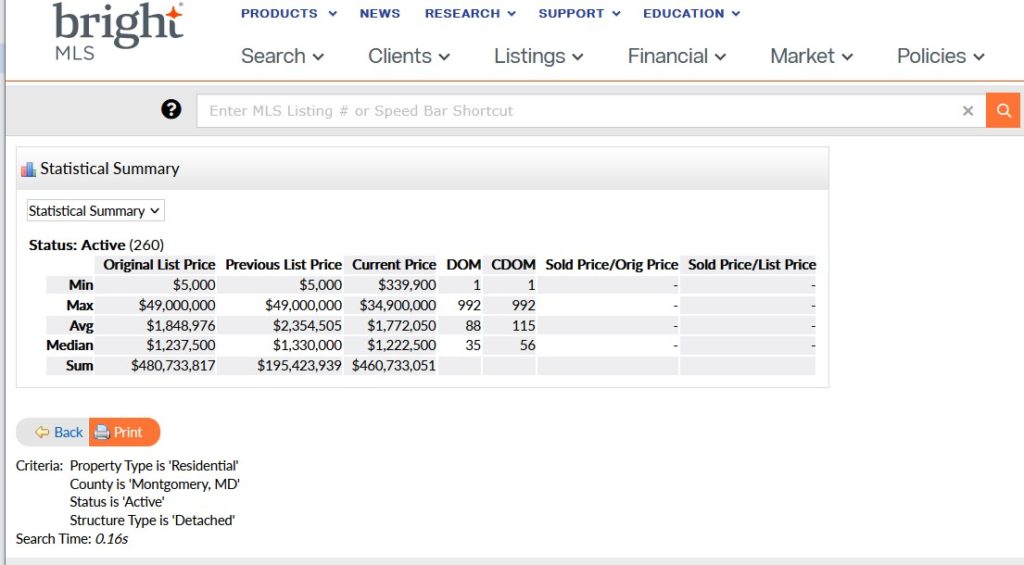

If you pull the latest data on home sales in Montgomery County, you will see there are currently 260 single family listings. The average sales price is $1,772,050. Why are we making it harder with higher taxes for anyone?