Just because we were curious, we decided to take a peek at the MCEA tax filing for 2023.

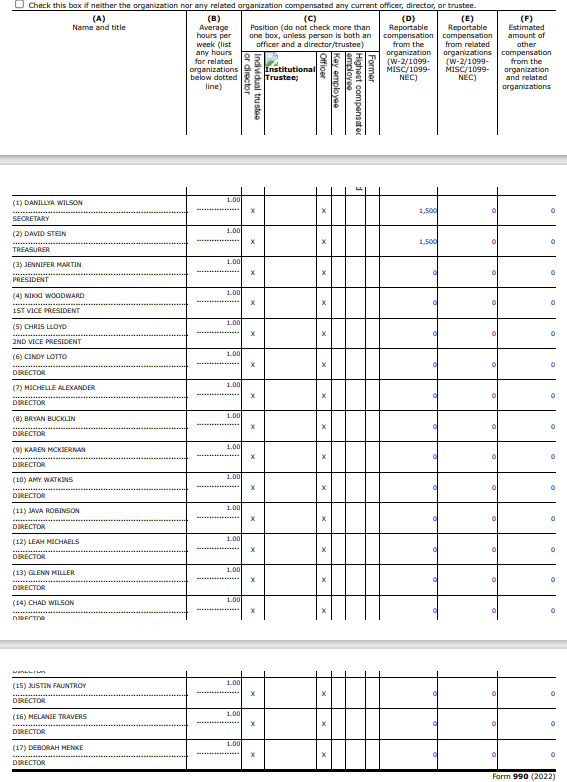

Part VII of the form 990 covers the Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors. Section A lists Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees. In the filing MCEA starts with its Board of Directors. These are MCPS employees (current or retired). It is not clear if the employees still employed by MCPS also work 40-hour weeks for MCPS, but in the tax filing, MCEA reports that each board member only worked an average of 1 hour a week. Two of the board members received some sort of compensation, but the rest seems to be on a volunteer basis.

If you remember 2023, you saw a lot of Jennifer Martin (President). Did she only work 52 hours during the year for MCEA? Is the Board of Directors position a 52 hour a year position?

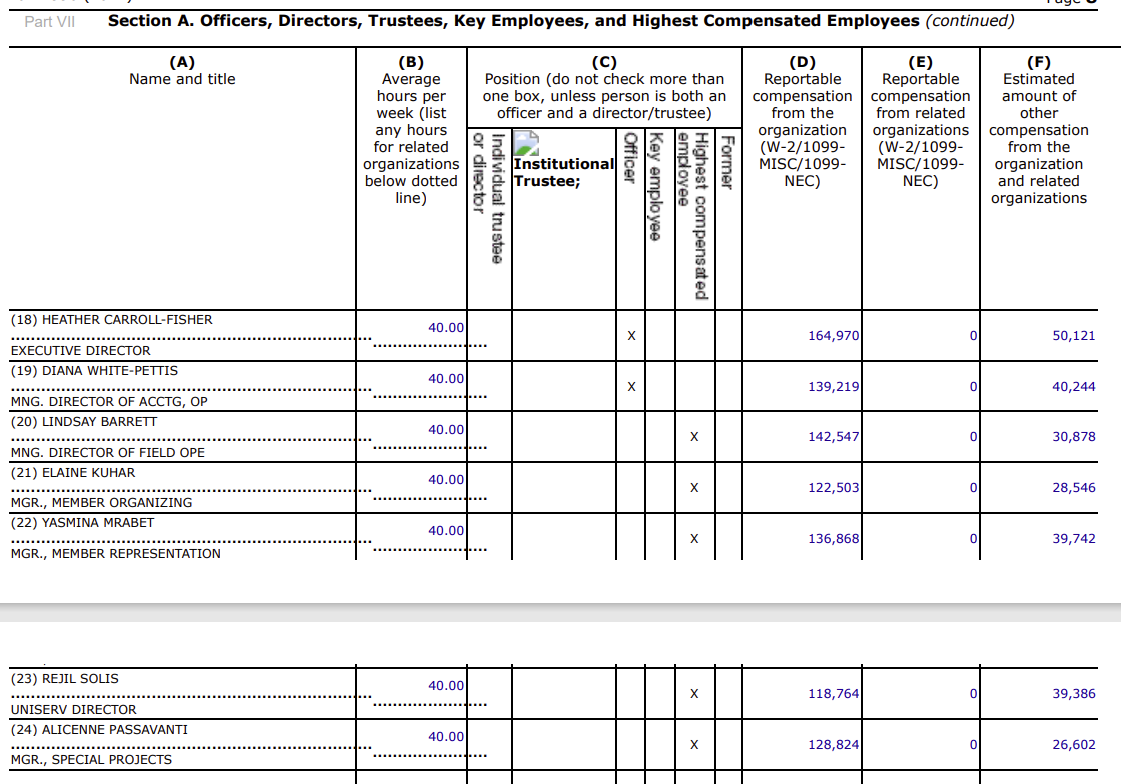

MCEA then lists its other executives and key employees, all of which are fully compensated. The Executive Director receiving compensation totaling $215,000, or over 3x the starting salary of an MCPS teacher.

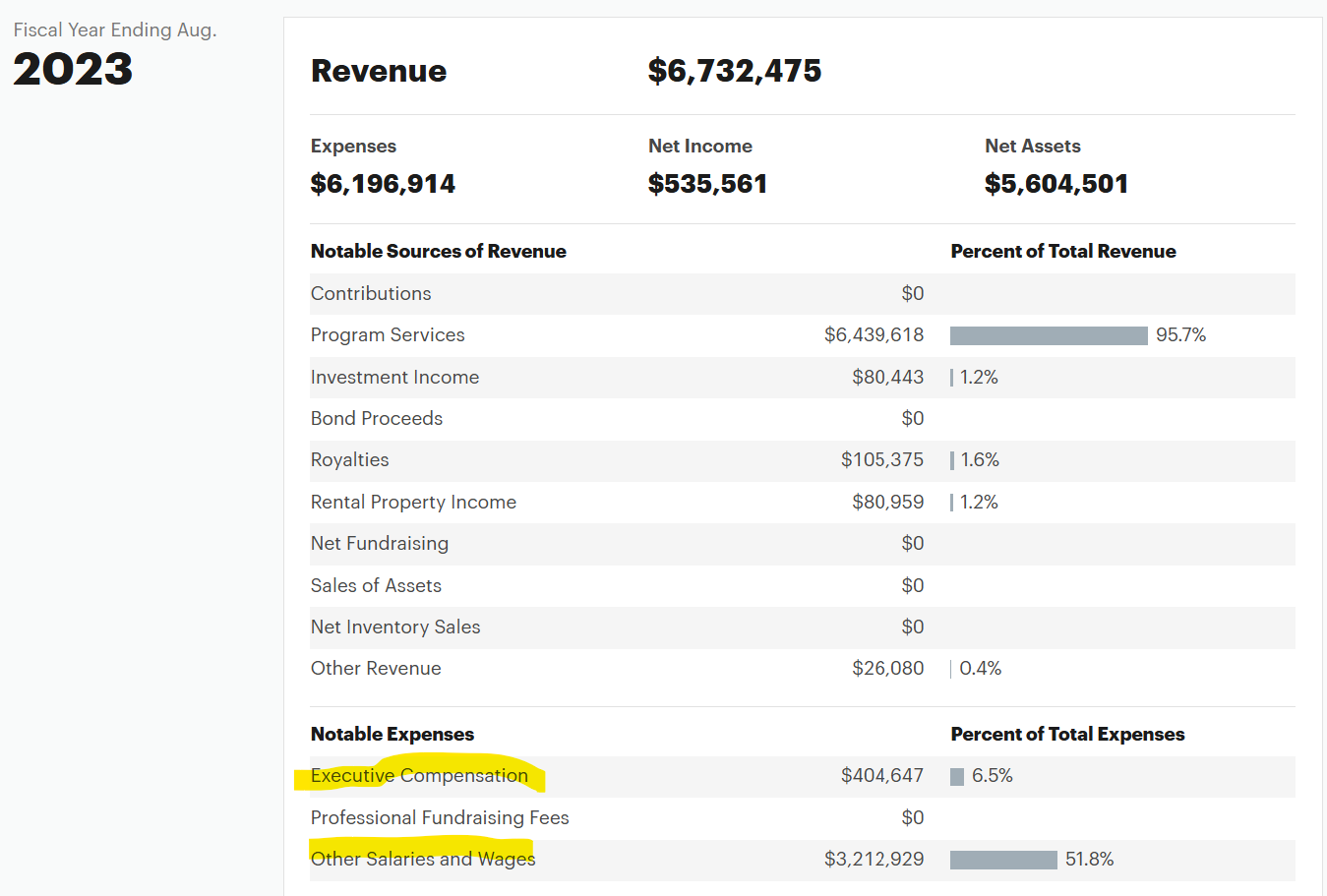

The employees listed represent a total compensation of $1,212,214. However these employees do not represent the total salaries paid by MCEA. If you look on non profit explorer for 2023, MCEA has the following.

In total, MCEA pays over $3.6 million dollars in salaries and wages.

The union bosses are always the happiest.