This came to my attention when reading a recent story by Ginny Bixby at MoCo360.media entitled “Ballot initiative would limit county executive to two terms” (September 15, 2023).

In it, Marc Elrich, the County’s second term Chief Executive and a 36-year career politician with little practical real-world experiences or any background in economics or personal finance, says he doesn’t think Montgomery County (and by extension Maryland) residents are “overtaxed”.

Responding to why Reardon Sullivan, a local businessman and former candidate for the County Exec office, might be pushing a new term limits ballot initiative in Montgomery County, Elrich said:

[Sullivan] doesn’t know what he’s talking about. He repeats this kind of trope that Montgomery County is an overtaxed place. It’s just flat out not true.

But it is true. Montgomery County and again, by extension, Maryland residents, are horrendously overtaxed. For starters, Maryland allows the “local income tax” to be calculated as a percentage of your taxable income. “Local officials set the rates, which range between 2.25% and 3.20% for the current tax year.” Guess where MoCo’s politicians (including Elrich) set that rate? The very high end or the low end? Hmmmmm. By definition, MoCo is “overtaxed” compared to even neighboring Frederick County, where the rate is set at sub-3% (2.96).

Maryland (and again, by extension, MoCo) also doesn’t index its income tax rate “brackets” to inflation. What does this mean? It means if you are blessed enough to make more money as a result of “cost of living” increases to “keep up” with inflation, you’ll likely be bumped up into a higher income tax rate bracket on the excess money and then you’ll be taxed at a higher percentage on money that, yes, buys less goods and services (remember, inflation). Does Elrich understand this? Care? It isn’t something he or the Council could directly change but their collective voices could push for a change in Annapolis and it would likely get adjusted in one statehouse session. He says nothing about it.

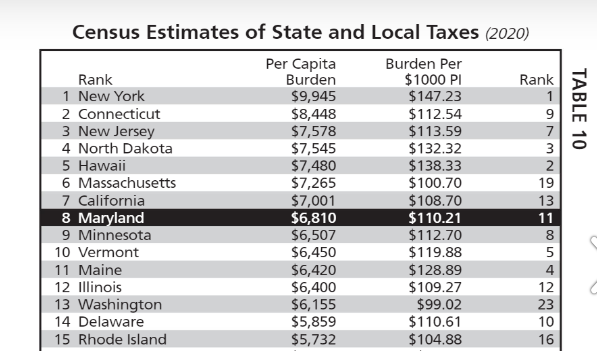

Regarding the total tax burden, he’s just wrong once again. Marylanders are overtaxed and MoCo residents have it pretty much the worst. We see it everywhere and experience it on basically every transaction or attempt to live a regular, lower-cost existence in MoCo. Look at this table from the Maryland Chamber of Commerce’s “Competitiveness Redbook 2023” publication:

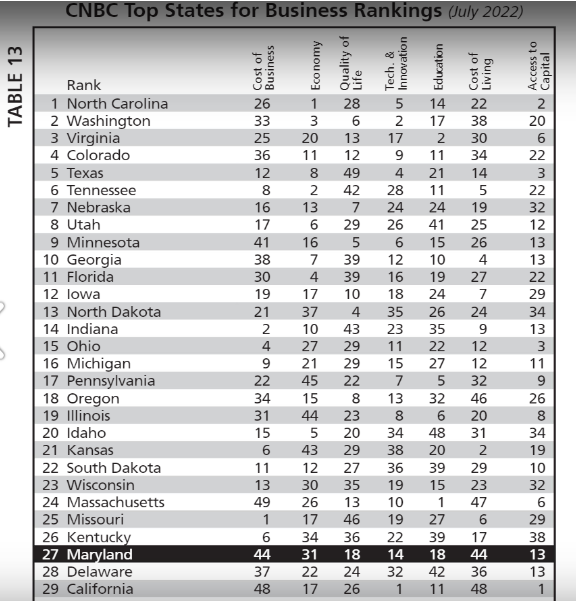

That’s over three years old now but guaranteed the trend hasn’t gotten better. In fact, Maryland is staring at further tax hikes on a range of services and businesses, and Governor Wes Moore hasn’t ruled out further tax hikes — because MD is already in the red for its next budget year. The gas tax is now top-3 in the nation and just jumped again on July 1st, 2023. Montgomery County just raised its property tax rate again, as well as the real estate recordation tax. The same publication shows this table, re-published from CNBC.com’s July 2022 rankings on “Top States for Business”. See that #44 for “Cost of Living” next to Maryland? Abysmal.

Marc Elrich is out of touch with economic reality and political reality. The longer he remains in public office (now headed to year 37 as a politician), the worse the business and economic climate in MoCo will get. And this then trickles into other areas of civic and family life for those in Montgomery County.

A clean slate is badly needed in MoCo, starting at the top.