The English writer Edward Bulwer Lytton said, “The pen is mightier than the sword.” At Clean Slate MoCo, we say, “Taking a percentage is mightier than a Russian T-90 tank (if the Russians still have any).” Let’s apply that principle to the bag tax.

Plastic bags are indeed a problem. If I’m eating a take-out lunch in the driver’s seat while navigating the Mario-Kart curves on the Beltway, and the bag blows out of my car and lands in Rock Creek Park, then I need to pick that bag up or reimburse the county for cleaning it up for me.

How realistic is that? As you drive along the Beltway or Georgia Avenue and see the litter around you, how can we possibly catch and punish the offenders?

One way is to privatize every single friggin’ square centimeter of land in the county, and let the owners decide if they want to clean it up. However, most people aren’t ready for that social arrangement, so we need to look for something else.

Enter the bag tax. Montgomery County Inspector General Megan Davey Limarzi recently issued a report about the bag tax. In it, she recalls tax’s motivations:

- Raise revenue to offset waterway cleanup costs.

- Create an incentive for consumers and retailers to use fewer disposable bags.

This tax is a perfect example of “social engineering”—forcing people to do something they don’t want to do. Social engineering is characterized by regulations, statutes, and codes; it creates special interests, black markets, evasion, and enforcement bureaucracies. It turns otherwise innocent residents into criminals, and it never accomplishes the objective for which it was established. And when the regulations don’t work, the government layers on ever more enforcement to make sure people do what they’re “supposed” to do.

This pattern is playing out in Ms. Limarzi’s report. Because there is a suspicion that not all retailers are participating in the bag tax, she highlights enforcement measures that still need to be implemented:

- Create a master listing of retailers who should be remitting the bag tax to identify retailers who may not be remitting as required.

- Develop a strategy to enforce current tax regulations, including interest and penalties that may be imposed on non-compliant retailers.

Yup. Your favorite mom-and-pop Chinese restaurant, serving 25 take-out orders a day, may not be participating in the bag tax, and Ms. Limarzi wants to set up an entire bureaucracy to find and punish it. Is that reasonable? How do we know the owners of that restaurant are actually the litterers?

Because of the lax enforcement, Ms. Limarzi revealed the following bombshell:

The actual amount of lost revenue, however, could be as high as $8.2 million per year.

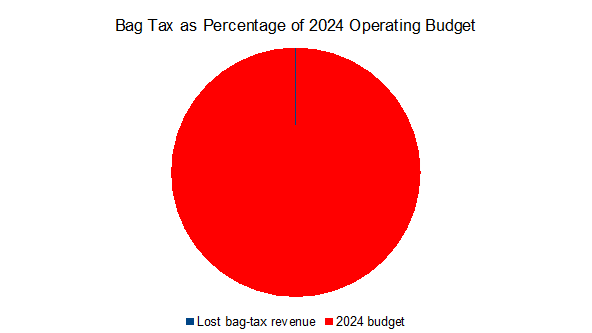

The methodology Ms. Limarzi used to come up with $8.2 million isn’t clear, and the leakage is probably much, much smaller. Regardless, using her numbers, the county is out at most $8.2 million/year due to lax enforcement of the bag tax. How much is that in dog years? Don’t know, but let’s take a Russian T-90 tank percentage of the county’s $6.8 billion operating budget.

That small blue line at the top, if you can see it, represents 0.12% of the operating budget.

There really, really, must be bigger fish to fry. For example, eliminating 1% in waste in county operations results in $68 million in savings, far more than enough to hire workers to clean up the bags, and without sending inspectors and lawyers after our precious small businesses.

(If Ms. Limarzi really were concerned about capturing small-change lost revenue, she could start with the excess amounts council members Kate Stewart and Kristin Mink took from the public election fund.)

Ms. Limarzi makes the following observations:

- MoCo’s Finance Department came to the conclusion that it is not feasible to identify all retailers liable for the bag tax (so the tax is being enforced unevenly).

- To make up for the lost revenue, property taxes were unfairly increased.

- There has not been a solid evaluation to determine if the tax is working at all to reduce litter and bag consumption.

I would add the bag tax is regressive: the five cents per bag means a whole more to struggling residents than to wealthier ones.

My conclusion: We don’t know if the bag tax reduces litter, we don’t know if it reduces plastic consumption, the tax isn’t being collected fairly, and it is making complex modern lives even more complex. Let’s put the bag tax in a plastic bag and toss it.