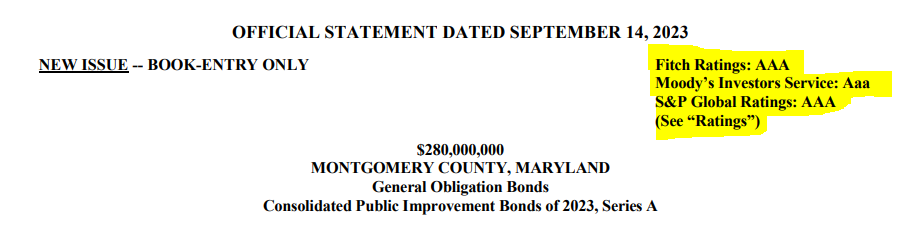

Montgomery County’s Department of Finance issued a routine statement in mid-September about County “General Obligation Bonds” the government is looking to sell to investors. MoCo is seeking to raise $280 million via selling debt to interested parties. Of course, off the bat the County loves to showcase its “Triple A” ratings via Wall Street firms like S&P and Fitch, on the prospective debt notes (page 1):

We’ve covered why these ratings, though important to a degree, aren’t some kind of “market approval” or Wall Street pat on the back for Marc Elrich’s poor economic track record and over-spending. The only reason the bonds MoCo issues are rated “Triple A” is because the ratings agencies are in love with the County’s proximity to “Fed Daddy” jobs and spending, aka the Federal Government’s large, oversized presence in the MoCo jobs-and-tax base. This privilege, afforded to so few counties in America, is being squandered — as evidenced by MoCo’s weak job growth, utter lack of success in attracting big private sector employers (see Northern Virginia for comparison), and its one-party government literally spending and regulating away future economic prosperity.

Oh, and that federal government MoCo politicians habitually rely upon for all their spending? It is facing a worsening fiscal outlook with “a whopping $879 billion on interest payments in FY23.”

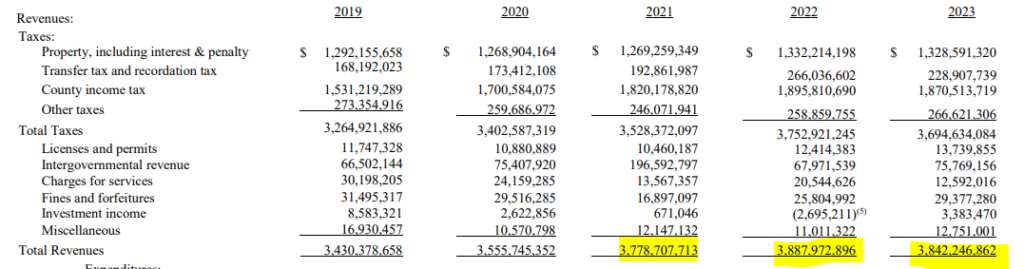

So, how do we know the over-spending is occurring and how do we know the MoCo economy isn’t booming or flush with new jobs? Because the MoCo government’s own numbers confirm it, courtesy of ‘Table 6’ on page 15 of their bond report as they seek to finance government via debt. Total taxes (i.e. the revenue base) are pretty stagnant despite all the taxes and fees that have been raised under Marc Elrich and the County Council in just the past year (although many were indeed just hiked and have yet to be reflected):

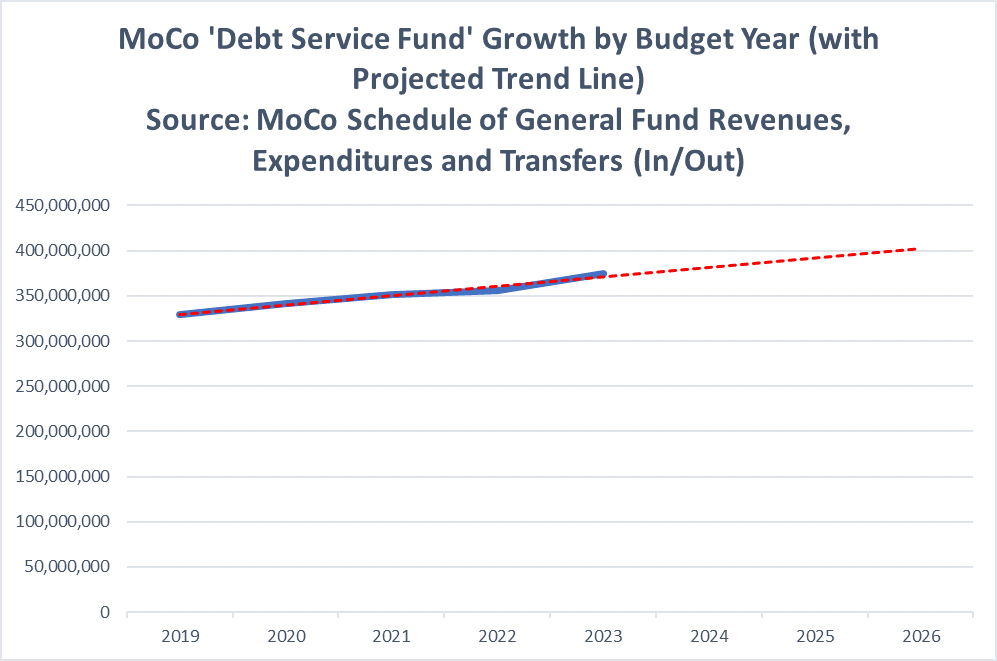

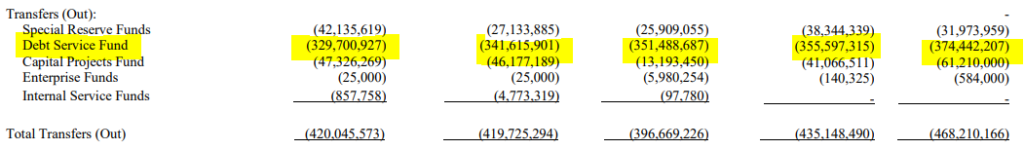

And, the ‘debt service fund’ in the “transfers out” section of this table shows steady growth. Year after year:

What is a debt service fund in government-speak? Well, per the state of New York’s Office of State Comptroller we get an easy answer:

Debt Service Funds record the accumulation of resources and payment of principal and interest on general long-term obligations and payments on certain lease/purchase or other contractual obligations. Debt service payments are generally tax-supported via operating transfers from the General Fund.

Debt service for MoCo, when charted and fit with a simple linear trendline (see image in beginning of article), projects to about $400 million by about budget year 2026 – which would actually start in July of 2025. But this chart / prospective trendline most certainly isn’t taking into account higher interest rates which are hitting all debt instruments in the government sector right now. As I type, yields on the 10-year US Treasury Bond were hovering just under 4.9%. It seems highly likely that this total debt service cost for MoCo is headed above $400 million per year before calendar year 2025 as new bonds at higher interest rates get issued.

Look, the County isn’t going bankrupt imminently… but the debt service cost are on a glide path to consume more and more resources in budgets that should be going into the actual MoCo body politic. $400 million is being diverted to bondholders, not roads, bridges, or physical infrastructure that people actually use. This is the very real world problem with compounding bad policies after decades of anti-business, anti-prosperity activists on the County Council – people like career politician Marc Elrich.

We also know that the County’s economy isn’t “booming” or really even growing right now. It treads water, waiting for more federal stimulus. These numbers prove it. In a growing, thriving local economy with new jobs and employers and home sales, the County wouldn’t need to continuously raise debt or taxes — the tax base would be growing organically. That simply isn’t happening under faux-socialist Marc Elrich.

Investors beware.