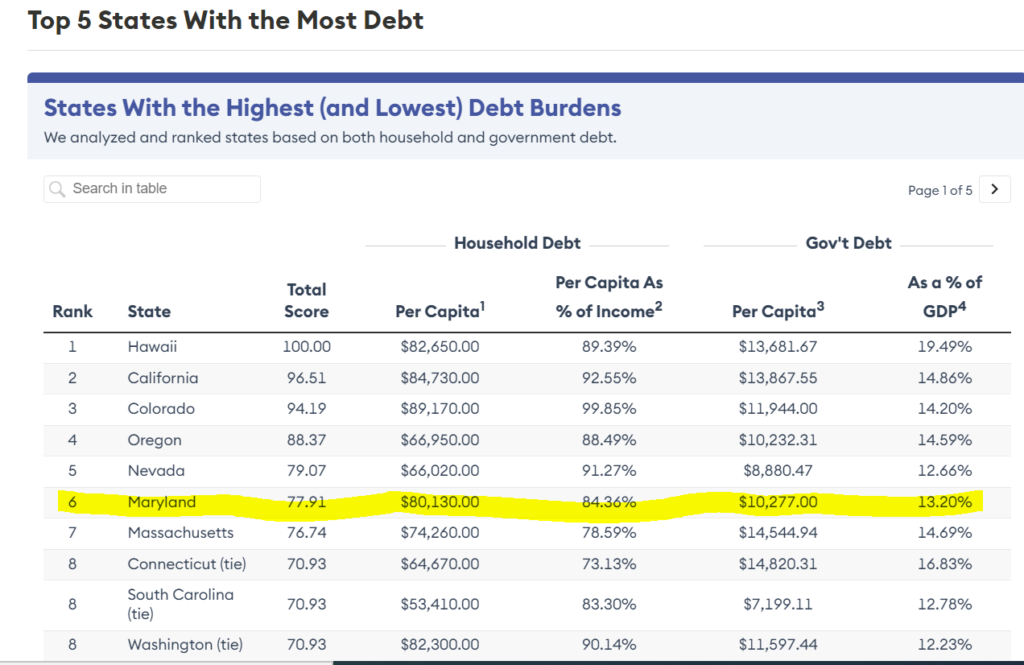

New research from Forbes Advisor shows that Maryland sits just outside the top-five of states with the most “combined” debt. Forbes in this case defines total debt as “household debt” and “government debt”.

Why does this matter? Well, for starters, elevated government debt thanks to Democrat-controlled Annapolis means that:

When a state owes more than it brings in, its residents may face financial insecurity due to budget cuts and tax increases. Consumers may also have high costs of living and outsized debt-to-income ratios to contend with.

Hmmmm. Higher government debt means high costs of living for residents? You don’t say. Gee, I wonder if that’s something actively biting Maryland and MoCo families these days. Of course, the Montgomery County Council is currently working to make the cost of living higher and higher, especially in housing and rentals — and actively ignoring sound advice from the people actually in the industry! Oh, and can’t forget inane regulations on business that increase the costs to consumers. MoCo government loves those. Thankfully CM Jawando has withdrawn his “menstrual products in every bathroom” bill. For now.

Anyways, here is the screen cap of the chart produced by Forbes Advisor, where we see Maryland once again trying to chase indebted California, its “policy and tax-and-spend big brother”:

Interestingly, eight of the top ten states listed here are run by Democrat governors, while only two have Republican-led top executives. But, that’s a topic for another time and post.

Regarding this data and the accompanying chart, a reasonable (adult) leader with a semi-functioning rational mind, some basic economic learnings or readings, and a 5-to-10 year time horizon would conclude that it would be prudent to stop the over-spending in Annapolis or in Rockville, and de-leverage a bit. Prioritize “needs” from “wants” and get back to basics. They’d also pay attention to the fact that the Federal Government, a massive part of MoCo and Maryland’s “economic engine”, is in a deteriorating financial situation and is now $34.1 trillion in debt, with some $8 trillion in prior debt needing to be re-financed soon.

Not so in Maryland however, and this kind of long-term view is not the case with Montgomery County Executive Marc Elrich. He proposes spending even more:

I have released my recommended Capital Improvements Program (CIP) budget for Fiscal Years 2025-2030. This proposal calls for a six-year investment of $5.8 billion, which is a modest 2.3 percent increase over the previously approved CIP.

He then goes on to lament that MoCo doesn’t have “Northern VA’s tax structure” to fund infrastructure (there is plenty of money to fund infrastructure in Maryland and MoCo, the politicians just throw it at other special interests) and claims that “our rate on corporate taxes over the past decade has remained low compared to Northern Virginia’s. Yet, that has not kept it from growing and attracting business.”

I did a super quick search. Virginia has a flat 6% corporate tax rate. Maryland’s corporate tax rate is 8.25%. Now, Elrich wants more “special taxing districts” in MoCo to fund his pet “infrastructure” ideas. How will this make Maryland more competitive with Northern VA?

Laughably, later in his post about spending still more money on failed transit ideas, Elrich claims that “I generally do not pay attention to the “comment section” of the articles, but I did catch this response from “Krench” on the Washington Post’s coverage of our recommended CIP budget.”

Does anyone actually believe this?

If you do, I have a new bridge across the Potomac river to sell you. Low price, great bargain.