Here at Clean Slate MoCo we are very cautious about discussing issues at the national level. I’m begging an exception for this post, because we have a confluence of policies at the national and local level that can only be considered a war against the poor.

In May 2024 President Biden increased the tariff on Chinese electric cars to 100%. This is not a partisan decision: President Trump laid the initial tariff of 25% back in 2018. Reasons for the tariff are the routine: national security, unfair competition, and American jobs. (I’m not comfortable that a member of the Chinese Communist Party knows I’m driving its EV to CVS to buy a dose of Preparation H; others may be less inhibited.)

According to Electrek, the Chinese EV Seagull has an entry price of only $9,700. After the tariff the price jumps to $19,400, compared to Tesla’s entry-level Model 3 at $34,000 (after the atrocious $7,500 federal tax credit), and Koons in Clarksville recently offered a used 2023 Chevrolet Bolt for $17,250. This is the impact of the Trump-Biden EV tariff: getting a low-end EV costs all of us between $7,550 to $9,700 more than without the tariff.

Tariffs are a regressive tax, because rich or poor, everyone pays the same amount. If you want to prevent Chinese spying through its EVs, or if you want to protect American jobs, then tariffs are the way to go, but the poor are paying proportionally more for that policy than the wealthy. For some, that $7,550 increment is a daily wage; for others it means foregoing needed medication. Regardless, it’s the poor who are forced to pay for this policy more than the wealthy.

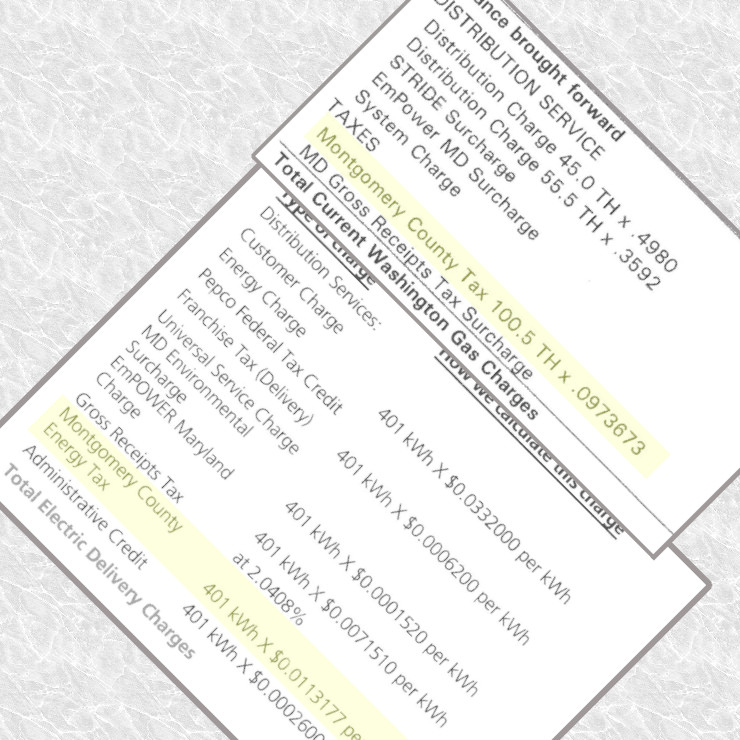

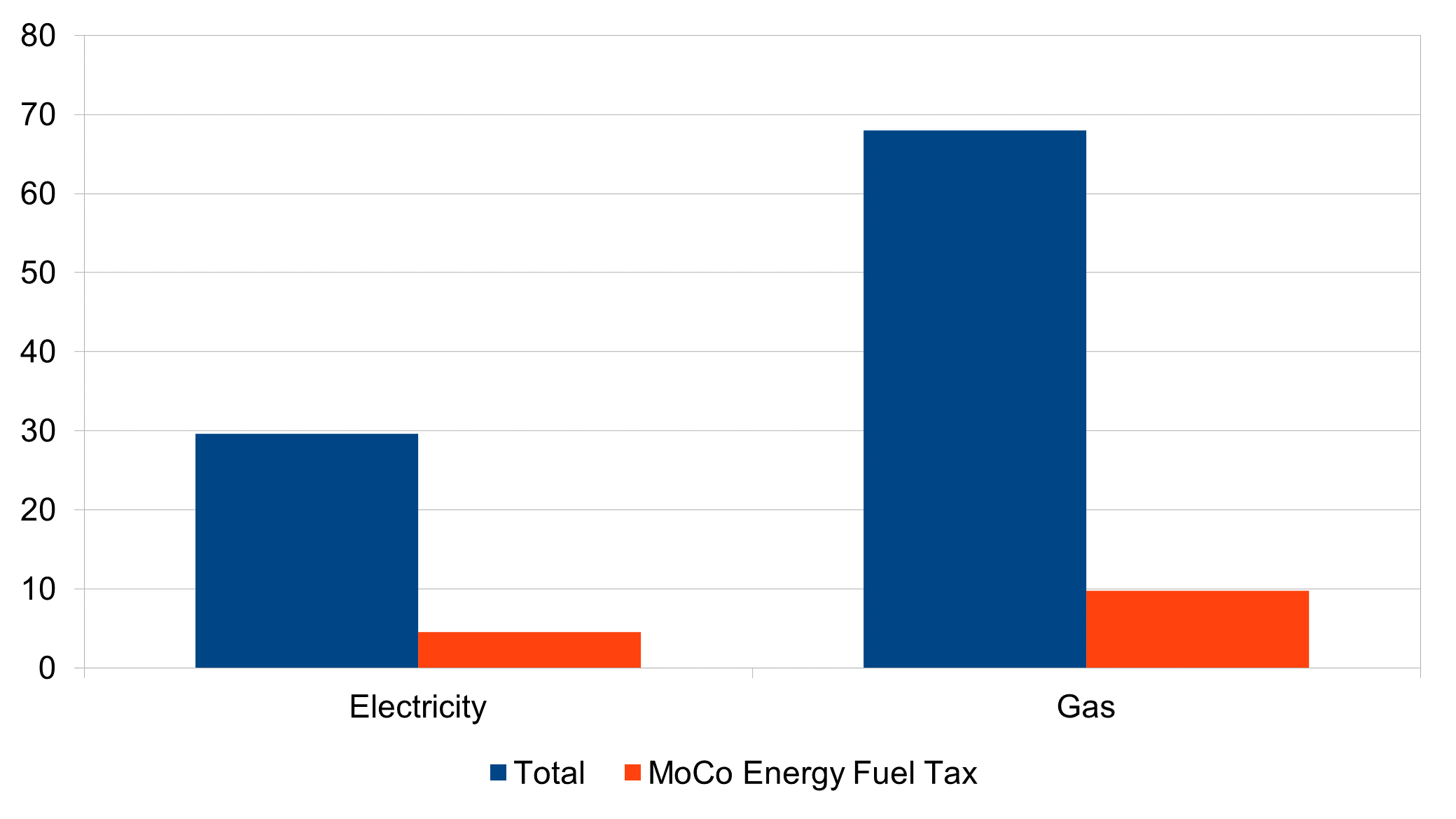

This ties back to MoCo’s many policies of ensuring the poor stay poor. Our county has a “fuel energy tax” on the sale of fossil fuels. This tax increases the retail cost of the gasoline we purchase at the corner gas stations, our electricity bills, and our heating bills. Here is what I paid on some recent utility bills.

For a $30 electricity bill, I paid almost $5 (15%!) in county tax; for a $70 gas bill, I paid $10 (14%) in county tax. It’s not the amount that is atrocious, it’s the percentage. Look at your Pepco and Washington Gas bills, and you’ll see similar numbers.

About 16¢ of the price you see advertised on the corner gas stations is the fuel energy tax. If you’re sophisticated like I am, you have a white-collar job, earn a reasonable salary, drive into the office twice a week, and hardly buy gas any more. If you are a laborer in retail, food service, or construction, you’re not making a great salary and you’re showing up for work every day and you’re paying the fuel tax at the gas pump—more than I am, and that’s regressive.

Who doesn’t pay our fuel tax? Those residents who are swanky enough to adopt renewables. Marc Elrich is one of those cosmopolitan residents who detailed for us his transportation choices that include an electric vehicle and solar panels. He pays much less fuel tax because he can charge his car with his own solar panels, while our county’s poor are locked out of EVs and solar panels because of federal tariffs, and are further punished by the county’s energy fuel tax.

Is this fair and equitable? In May 2012, when Marc Elrich and a few other memorable characters were on the county council, they made the following statement:

The Council finds that it is fair and equitable to continue different rates for fuels and energy transmitted, distributed, manufactured, produced, or supplied for residential and agricultural purposes and for non-residential purposes.

The next time you see a food service worker, gardener, or home care provider, think about how much extra they need to pay so the progressives can have their green lifestyles.