Clean Slate MoCo and other opposition outlets hold paramount the responsibility and accountability for the county’s elected, appointed, and shadow leadership. Not everyone is comfortable taking the opposition outlets seriously, and for them there is the county’s Office of the Inspector General.

The OIG is tasked with the following (source):

- Review the effectiveness and efficiency of programs.

- Prevent and detect fraud, waste, and abuse in government activities.

- Propose ways to increase the legal, fiscal, and ethical accountability of departments and agencies.

Review, prevent, detect, and propose it does. In its annual report for FY2023, the OIG summarized its primary fiscal impacts for the previous fiscal year.

| Category | Fiscal impact |

| Improper payments (MCPS Dept of Transportation) | $133,000 |

| Identified theft (MCPS Dept of Transportation) | $1,600 |

| Lost revenue (bag tax) | $210,000 |

| Better use (fees paid to web site) | $23,661 |

| Unreported spending (COVID-related emergency food access) | $160,000,000 |

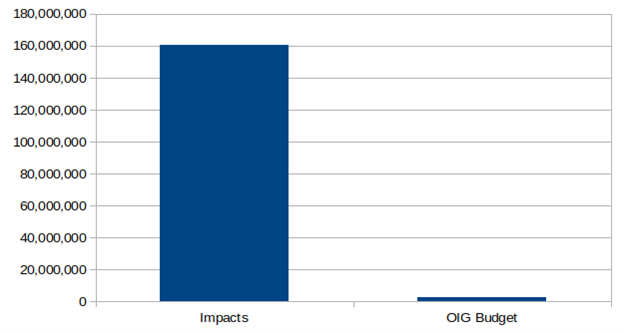

Let’s compare these impacts with the OIG’s budget of $2.5 million.

That looks like an effective use of our tax dollars: in return for a $2.5 million budget, the OIG identified over $160 million of impacts, amounting to 64% on every dollar in its budget. You can’t get that kind of leverage in a Lehman Brother’s hedge fund.

Let’s take a closer look at these impacts.

The highest impact was over $160 million associated with emergency food procurements during COVID. These under-reported amounts pertain, according to the OIG’s own report, to a misclassification. “As a result, it appears that Procurement may have under-reported hundreds of emergency procurements totaling over $160 million from FY20 to FY22.” The Department of Procurement didn’t report this $160 million, but the county paid those bills. What’s not clear is if this large amount would have been spent anyway had it been properly authorized. We don’t have a convincing claim that the OIG actually identified funds that were disbursed inappropriately, and there is no indication that it’s going to claw back those disbursements.

The second highest impact pertains to $210,000 of lost revenue associated with the bag tax. In that particular report the OIG mentioned that it’s not clear if the bag tax is actually reducing litter; regardless it recommends making the county’s retailers’ lives ever more miserable by expanding fines and enforcement. (See our detailed response to this report.)

Under “funds put to better use” the OIG identified $23,661 paid by the Department of General Services to GovDeals.com for listing surplus county-owned government. Out of a FY2023 operating budget of $6.3 billion, the OIG found only $23,661 of funds that could have been put to better use. Let’s apply the euphemism “disappointment” to that finding. If the investigator who authored that report spent just one hour walking through the halls of any MCPS high school, s/he could have identified a whole lot more funds that could be put to better use.

The remaining two findings, theft and improper payments, pertain to MCPS employees doing what they can to get the county to pay for their moving violations or home electronics.

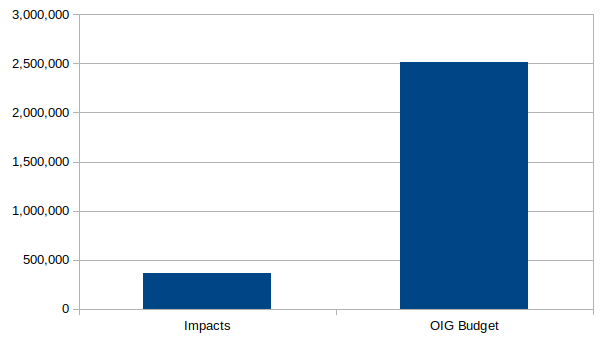

In summary, if we remove the $160 million of misclassified spending, the OIG identified only $368,261 of impacts in return for a budget of $2.5 million. Is this organization providing value to the taxpayers?

The biggest and most outlandish deficiency in the OIG’s report is the lack of interest in evaluating the necessity of a county operation. Is the MCPS even necessary? Is it necessary beyond middle school? Is the MCPS’s Department of Transportation necessary, or can it be privatized? Same with the Alcohol Beverage Service’s monopoly. Until the OIG takes a hard look at privatizing or terminating some mismanaged and unnecessary county services, it’s merely a cog in a county-wide bureaucracy that seeks to survive, not to serve.