Montgomery County’s Consolidated Retiree Health Benefits Trust (the fund used to pay out retiree healthcare expenses for former MCPS and Montgomery College employees, among other county retirees) is under-water and has less then 50% of the assets needed to satisfy projected liabilities/claims in the years ahead, per official reporting issued by Montgomery County government and due again this year at the end of June, 2023.

This isn’t to say the plan is in any “code red” immediate danger of going bust and having to cut payouts to retirees (of which there are almost 7,450 currently participating as of last year’s report) for healthcare, but it does showcase the liabilities ahead and coming at the County soon — and the can-kicking the County Council has done for nearly two decades. At some point soon, absent a rip-roaring economy, a “bailout” might have to occur (meaning taxpayer money going into this, not new schools or roads) or cuts will have to happen and seniors are in for some really eye-popping bills they thought they had covered.

The report is officially called “MONTGOMERY COUNTY CONSOLIDATED RETIREE HEALTH BENEFITS TRUST FINANCIAL STATEMENTS AND SUPPLEMENTARY INFORMATION YEAR ENDED JUNE 30, 2022

WITH REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS” and is accessible here.

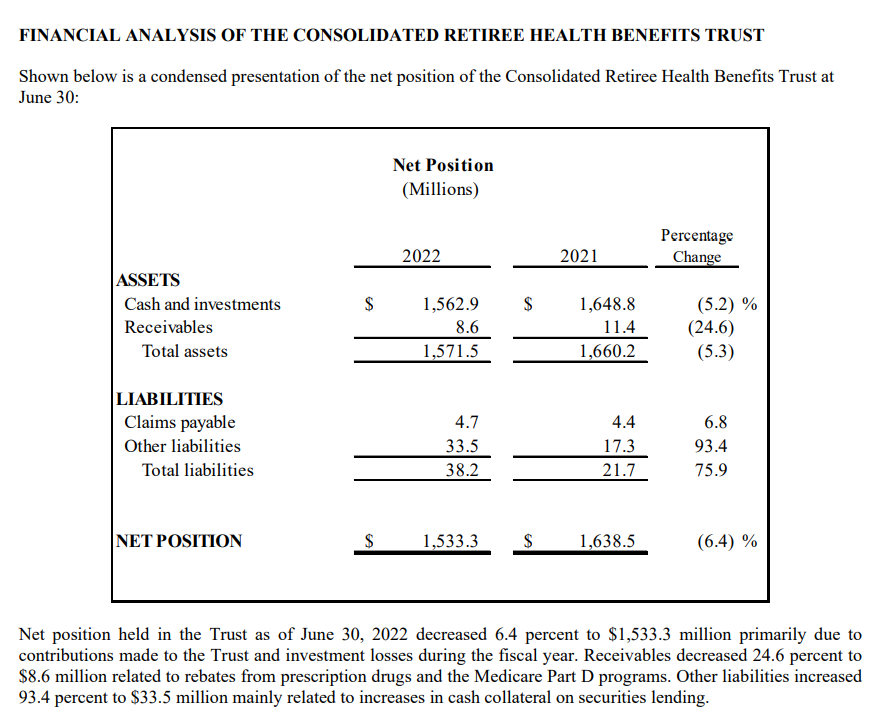

The most interesting pages of this report are here, on page six (below). It is here that county residents and retirees can see that the plan’s assets were down while the claims payable and other liabilities were up, further eroding the asset base from which to generate income / create a true “fund” for the future of retiree healthcare claims:

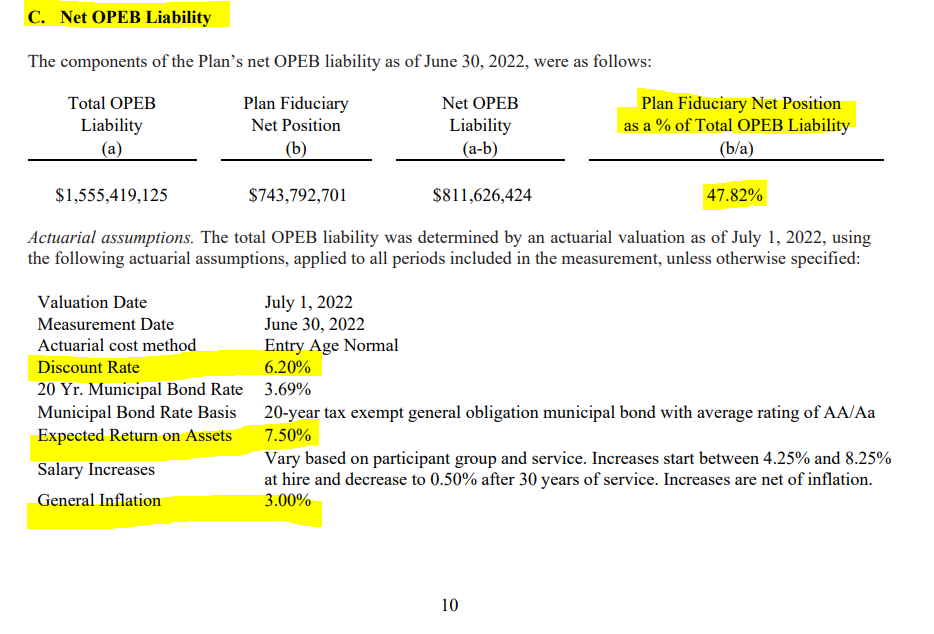

And then on page ten of the report, below screen capped, we see some fairly ridiculous assumptions for both a return on assets and general inflation rates. Inflation in June of 2022, as this report was being prepped, was over 9.1% year over year. It has been trending down but it is guaranteed the average inflation rate for the year dated June 2022 to June 2023 is going to be over 6%, or double what this “Net OPEB Liability” model is assuming.

Assuming an expected “return on assets” of positive 7.5% seems very dubious as well. The S&P 500 index, the most-quoted / benchmarked in all of the entire investment industry, lost 18.11% during 2022, even including the return from stock dividends. Gold, the pinnacle of “safe havens” for wealth, returned only 0.44% in 2022.

More to come at the end of June / early July when this reporting is (hopefully) refreshed and re-issued. It will be fascinating to see what has occurred in the prior twelve months and what the new liability looks like for the fund — has it grown wider? Or has the fund found some secret investment that is booming in the world markets? Contrary to what County Executive Elrich and Chief Administrative Officer Madaleno want to pitch, there is no federal “Medicare for All” bill upcoming this year or next, nor a federal bailout upcoming for this fund. It seems unlikely the state of Maryland would want to bail it out, either.

Montgomery County career politicians like Mr. Elrich are hoping to be out of office by the time the really tough, hard decisions occur as to what medical reimbursement gets cut and what gets “bailed out” via more taxes or re-allocating tax dollars away from needed things (like roads, bridges, police). But can he outrun, or “outkick” the can of economic reality?

Montgomery County retirees, or those soon-to-retire, need to know the whole truth and nothing but the truth, right now.